Part D plans are accelerating cost-shifting to beneficiaries, many of whom won’t reach the law’s new spending cap

Making prescription drugs more affordable was a key goal of the Inflation Reduction Act (IRA). However, most Medicare beneficiaries may end up paying more out of pocket for medicines as Part D plans adjust to the law’s new provisions, according to a new white paper from the USC Schaeffer Center for Health Policy & Economics.

The IRA starting this year caps Medicare beneficiaries’ annual out-of-pocket costs at $2,000 for covered drugs and eliminates the longstanding “coverage gap” for those with moderate drug spending — while shifting more costs onto Part D plans.

Although these changes provide Medicare beneficiaries with crucial protection against high drug costs, the vast majority won’t reach the $2,000 limit. Instead, most who don’t hit the cap will likely face higher out-of-pocket costs as insurers scale back plan features that make prescriptions more affordable at the pharmacy counter.

The white paper identifies two major shifts in Part D plan offerings that leave patients more exposed to drugs’ sticker prices:

- A sharp increase in annual deductibles, or the amount that patients pay out of pocket before coverage begins.

- Fixed co-pays for common brand-name drugs are increasingly being replaced with coinsurance, in which patients pay a percentage of a drug’s list price, often a much higher amount.

“The new annual cap will provide valuable relief to the small share of beneficiaries with the highest drug spending. But our research shows this comes with a clear tradeoff — most Medicare beneficiaries will likely see their drug costs go up,” said lead author Erin Trish, co-director of the Schaeffer Center and associate professor at the USC Mann School of Pharmacy and Pharmaceutical Sciences.

Shifting costs

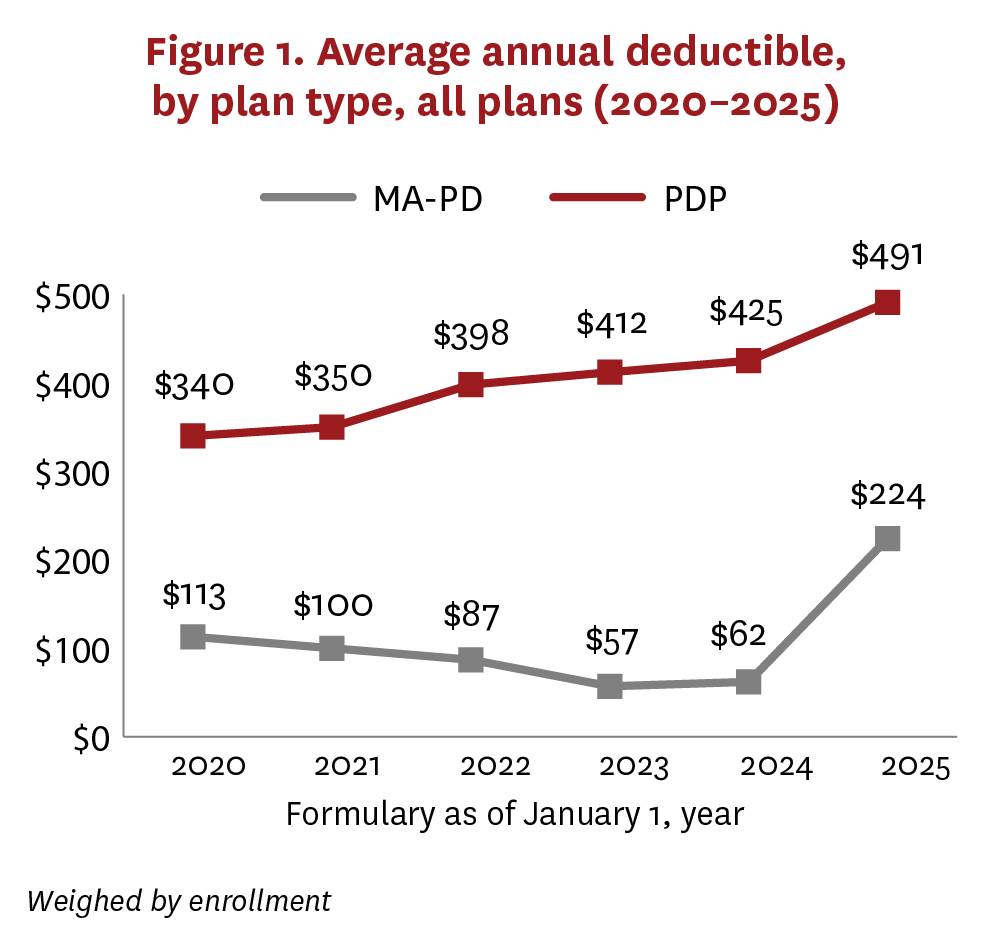

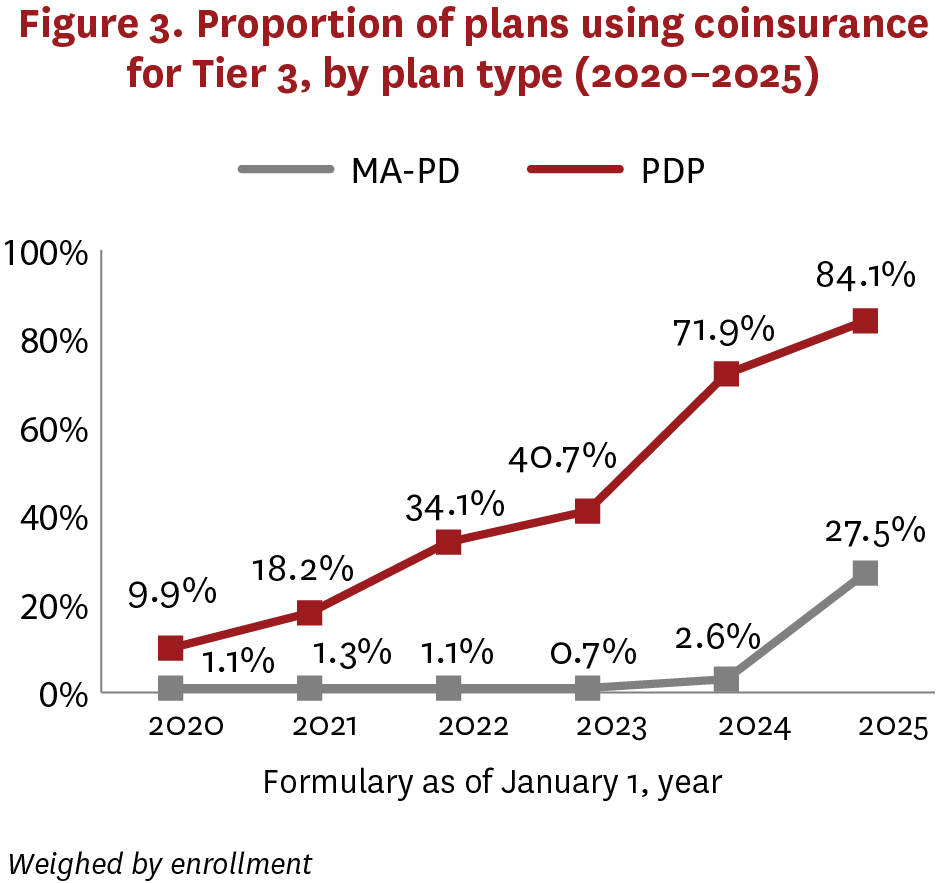

Researchers analyzed Part D stand-alone prescription drug plans and drug coverage within more comprehensive Medicare Advantage plans from 2020 to 2025.

Average annual deductibles in Medicare Advantage drug plans nearly quadrupled from $62 to $224 between 2024 and 2025, reversing years of declines or modest growth. This was largely driven by a steep decrease in the share of enrollment in more generous, “enhanced” plans with zero deductible, which fell from 78% to 41%.

In stand-alone drug plans, average deductibles jumped from $425 to $491 — the largest annual increase since at least 2020.

The share of enrollment in Medicare Advantage drug plans requiring coinsurance, rather than co-pays, for common brand-name drugs also sharply increased, from 2.6% in 2024 to 27.5% this year.

In the stand-alone drug plan market, this shift toward coinsurance has been more substantial and sustained. This year, 84.1% of enrollment was in plans requiring coinsurance for these medications, compared to 9.9% in 2020.

By linking drug costs to list prices, beneficiaries typically could expect to pay much more for widely used brand-name drugs, such as the blood thinner Eliquis or diabetes treatment Ozempic, the researchers found in a recent JAMA study. Coinsurance amounts, usually about 25% of a drug’s list price, are being driven higher as list prices are artificially inflated by secret rebates and discounts negotiated by pharmacy benefit managers.

The researchers said beneficiary costs for certain drugs may decrease in 2026, when the first prices set under IRA-mandated Medicare negotiations take effect. However, because of the expanding use of coinsurance, patients may still find themselves paying more for those drugs than they would have with flat copays.

“Despite the IRA’s many changes, patients are still burdened by a fundamental flaw in the drug pricing system,” Trish said. “Pharmacy middlemen continue to pocket savings while patients are left to shoulder rising list prices. Providing rebates directly to patients would meaningfully lower their costs, ensuring more people can access needed therapies.”

Barbara Blaylock, founder of Blaylock Health Economics LLC, is a co-author. This white paper was supported by the Schaeffer Center. A complete list of supporters of the Schaeffer Center can be found in our annual report.