Editor’s Note: This perspective was originally published in Health Affairs Forefront on April 9, 2025.

The US health care delivery system is widely acknowledged to suffer from high prices and poor outcomes. These problems are often attributed to the lack of government regulations, with a common solution being additional regulations to contain prices and improve quality. But these “solutions” often do more harm than good.

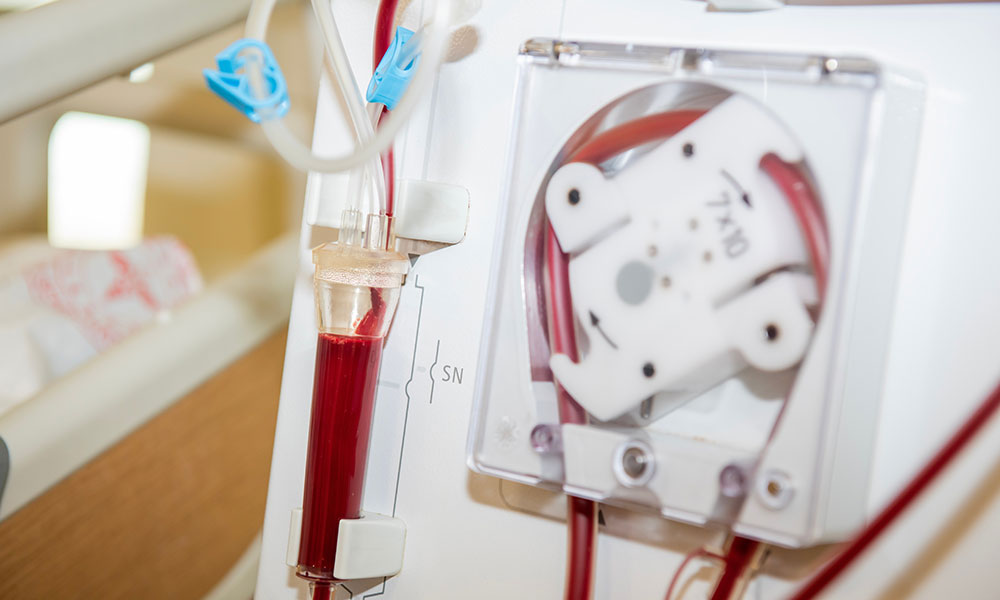

An excellent case study is end-stage renal disease (ESRD), a disease mostly treated with dialysis, primarily funded by Medicare, and heavily regulated. (More than 70 percent of patients with ESRD have Medicare as the primary payer.)

Dialysis in the US has become an ossified industry, experiencing little innovation over the past three decades, with in-center, brick-and-mortar hemodialysis the mainstay of treatment. ESRD outcomes are dismal, rivaling those of breast, colorectal, and prostate cancer: Fewer than 40 percent of patients survive more than five years, and patients are hospitalized on average 1.5 times per year. Home dialysis only represents 14.5 percent of dialysis care in the US, compared to nearly 25 percent in other Western developed nations.

The current dialysis market is highly concentrated, with two large corporations, DaVita and Fresenius, owning 75 percent of the dialysis market, and more than 25 percent of patients with ESRD living in counties where all facilities are owned by one or two corporations. Provider consolidation has led to high prices, imposing substantial burdens on taxpayers and patients.

Although multiple factors contribute to the disappointing state of US dialysis care, regulatory failures are perhaps the most important driver. In this Forefront piece, we examine three ways in which government regulations distort dialysis care, encourage and entrench consolidation, prevent innovation, and inflate prices. ESRD should serve as a cautionary tale for policy makers seeking to avoid the pitfalls of poorly designed policy.

Market concentration, high prices, and financial burdens on taxpayers and patients

A prominent example of how Medicare regulations maintain and reward market consolidation is the requirement that Medicare Advantage (MA) plans certify that their provider networks are adequate. (In 2021, the Centers for Medicare and Medicaid Services [CMS] relaxed network adequacy requirements for dialysis facilities, but MA plans still must attest their dialysis networks are adequate.) Although well-intended, these regulations transfer negotiating power to providers and weaken plans’ ability to negotiate lower prices—if a dialysis provider in an uncompetitive county exits an MA plan’s network, the plan is put in jeopardy.

Our research suggests that large dialysis chains conduct all-or-nothing, national-level negotiations with national MA plans to obtain a single, inflated rate for all counties. By threatening to exit the plans’ networks around the country, large dialysis chains extract high markups even in counties with adequate competition. We and the Medicare Payment Advisory Commission have demonstrated that MA plans pay for dialysis services at rates up to 27 percent higher than traditional Medicare (Medicare Parts A and B), with the largest markups going to the largest chains. This is highly unusual, as most medical services are paid similarly by MA plans and traditional Medicare. High MA markups are caused by strong market power—independently owned and hospital-based facilities do not extract similar dialysis markups from MA plans, and some have even reported lower MA rates than traditional Medicare.

Large dialysis chains’ markups in MA plans pale in comparison to those in Affordable Care Act (ACA) plans, Consolidated Omnibus Budget Reconciliation Act (COBRA) plans, and other commercial plans, which pay close to three to six times traditional Medicare rates for dialysis. As a result, every Medicare-eligible patient who enrolls in any of these plans instead of traditional Medicare yields massive profits to large dialysis chains. Consequently, dialysis chains are incentivized to induce patients toward ACA and COBRA plans by paying for their premiums. Although they cannot do so legally, they are allowed to use a third-party charity organization, the American Kidney Fund, as a financial passthrough to make these payments.

By any metric, the scheme is massive. The charity had an operating budget of $349 million in 2023, with two anonymous donations of $173 million and $128 million, accounting for 86 percent of the budget. Previous tax filings have reported similarly sized donations from two anonymous entities. Because MA and ACA plans are largely publicly financed, high dialysis prices impose financial burdens on US taxpayers. Additionally, patients with ESRD enrolling in ACA, COBRA, and other commercial plans may face higher out-of-pocket costs for a given service. Multiple lawsuits have been filed to challenge these practices. CMS considered closing this loophole in 2016 but never did.

Onerous quality measures and low quality

CMS has two programs intended to incentivize higher-quality dialysis care: the Quality Incentive Program (QIP) and Dialysis Facility Care Compare (DFCC). The QIP scores dialysis facilities on 18 measures annually, penalizing the worst-performing providers by up to 2 percent of Medicare reimbursements. DFCC aggregates quality performance across a different suite of measures to produce a five-star rating, which is intended to help patients identify high-quality facilities and is published quarterly online. Unfortunately, both programs are confusing and onerous, with inconsistently overlapping and sometimes conflicting measures.

In 2025, facilities are held accountable for a total of 25 total measures, with only 11 overlapping in both programs. Among the 11 measures, only seven have identical specifications, while the remaining four differ in risk adjustment and estimation between the QIP and DFCC. Nine of the 25 measures are risk adjusted, but each uses a different risk-adjustment methodology. Additionally, the patient populations considered for each measure vary—some include the facility’s entire dialysis population, while others are restricted to the entirety of Medicare or traditional Medicare patients.

As more measures are added, the complexity grows. The quality measures manual for both programs ballooned from 150 pages in 2016 to 280 pages in 2025. The measures require a bevy of administrative claims and other data to be submitted by dialysis providers to an online portal. They also rely on a survey that ostensibly summarizes patients’ experiences at facilities. Unfortunately, the survey is 62 questions long, and it should be no surprise that the response rate was less than 30 percent in 2024.

Adding to administrative confusion is the Quality Payment Program, used to adjust nephrologists’ Medicare payments. While nephrologists are reimbursed separately from dialysis facilities, they manage dialysis prescriptions and directly influence facilities’ quality performance. Nephrologists managing dialysis in traditional Medicare must select six measures from a proliferating set of 196 official measures, with an additional 520 measures submitted and maintained by Qualified Clinical Data Registries. Although some nephrology-relevant measures coincide with QIP and DFCC measures, they have their own unique specifications.

Do these measures improve care quality? Recent research suggests that penalized providers do not improve their scores in subsequent years. In research in press, we demonstrate that DFCC ratings do not help patients identify or select higher-rated facilities. Importantly, facilities located in low-income ZIP codes, which lack the resources to navigate this complex bureaucracy, have been most harmed by penalties.

Entry barriers and stifled innovation

The regulatory environment for payment and quality oversight clearly favors large incumbents over smaller, upstart, innovative dialysis providers. Market competition is further stifled by regulations that make it costly to enter the market. New dialysis facilities must comply with Medicare’s Conditions for Coverage to receive Medicare certification. Because more than 70 percent of patients on dialysis have Medicare, certification is de facto mandatory. However, the certification process is onerous and has been outsourced to state governments, which do not always act with expediency. Creative home dialysis providers seeking to innovate on dialysis delivery have cited difficulties in obtaining prompt certification as a key barrier to market entry.

To make matters worse, more than two-thirds of states have certificate-of-need laws, requiring prospective facilities to prove to state regulators that there is a low regional supply relative to demand by using expensive market studies. These regulations favor incumbency and slow the diffusion of dialysis care.

Policy implications

An ideal regulatory environment would safeguard patients and taxpayers, ensuring that health care providers prioritize high-quality, high-value care. However, kidney regulations have become bloated, confusing, and anticompetitive, achieving the opposite. Only large incumbent providers possess the size, know-how, and economies of scale needed to navigate the morass and influence the regulatory process to advance their market dominance and profits (that is, regulatory capture). These dynamics undermine competition, innovation, and quality of care, to the detriment of patients and taxpayers.

Due to its purview under Medicare, policy makers view ESRD as the tip of the spear for using regulatory tools to improve the market. However, the disappointing reality demonstrates the perils of ignoring the increasing weight of complex regulations. Unlearned lessons here could befall the rest of the health care industry, where consolidation continues, marked by massive growth in vertical integration by payer-providers and the acquisition of small physician practices by health systems and private equity firms. The increasingly complex value-based care models, certificate-of-need laws, and many other regulations are anticompetitive and reward large providers.

Eliminating wasteful government regulations should be a top priority for health policy makers aiming to ensure that facilities can compete fairly on price and quality, rather than on size or financial engineering. For example, quality programs should be parsimonious, with redundant, contradictory, and ineffective measures eliminated. Prospective entrants should face minimal barriers. Third-party charity pass-through payments to cover premiums should be banned, and providers should not be rewarded for anticompetitive bargaining tactics.

To its credit, CMS has streamlined kidney care by granting waivers to participants of the Kidney Care Choices Model, a payment model borne out of the Advancing American Kidney Health executive order, signed by President Donald Trump in 2019. These waivers relax regulatory requirements in post-discharge home visits, telehealth, and kidney disease education and allow model participants the flexibility to innovate in care delivery. CMS should use these experiments as examples for simplifying regulatory burden on providers.

In response to an ailing health care system, policy makers often codify or promulgate complex rules. Before doing so, policy makers should heed lessons from dialysis: Well-intentioned yet counterproductive regulations should be addressed first.

Authors’ note

Eugene Lin receives research funding from the National Institutes of Health (NIH) and consulting fees from Acumen, LLC, a federal contractor. Erin Trish receives research funding from the NIH, Commonwealth Fund, and Arnold Ventures, and is the co-director of the Schaeffer Center, whose funding sources are described in annual reports. She has served as a consultant and litigation expert on matters in the hospital, health insurance, health information technology, and life sciences sectors. Ge Bai receives research funding from Arnold Ventures.

“How Regulatory Failures Have Crippled Dialysis Care”, Health Affairs Forefront, April 9, 2025 .DOI: 10.1377/forefront.20250407.986223

Copyright © [2025] Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.